We have all had situations where our spending tends to run out of control and we look at various credit cards or other types of payments realizing we are not in full control of the situation. A great way to solve the problem of spending too much is to get a prepaid debit card. They will help you control your expenses, put a cap on your losses if you are traveling and your card, or for that matter want to teach younger family members about money. The great thing with prepaid debit cards is that you cannot spend money that is not on your card. For all practical purposes they work like checkless checking account. We will go through some of the best cards available.

Additional positive aspect of prepaid debt cards is that there are no credit checks when getting these cards. Furthermore, they are also available if let say you cannot open a bank account due to various reasons.

Things to Consider When Choosing best Pre Paid Debt Card

There are several important factors to consider before you choose your card.

- ATM Access: Look the availability to use the card at various ATMs around the country. Some good cards gives free access to countrywide ATM networks.

- Fees: Fees on prepaid Debit Cards can add up. It is important to check what the potential fees are. These could include fee to activate the card, using out of network ATMs, monthly fees, and making deposits.

- Amount Limits: Look into how much you are allowed to spend, withdrawal or reload during different periods.

- Reload Options: The more options you have to reload the debit card the better. The options available through cash, direct deposit, depositing checks at ATMs and online and more transfers.

Prepaid Debit Cards

Fifth Third Access 360 Reloadable Prepaid Card

- Important Features: The monthly waived if Fifth Third bank account or more than $500 in deposit monthly

- Credit Check: No

- Activation Fee: No

- Monthly Fee: $4

- ATM Network: Over 50,000 ATMs (Free at allpoint ATMs, $2.75 others)

- Purchasing: No fees

- Ways to Reload: Cash at Fifth Third Branch, Direct Deposit, Bank Transfer

This card is amazing if you are a Fifth Third Bank customer. They card is available in 10 different states. There are no activation or credit checks. You can also have several owners on the card. This is a really good card if need to do ATM withdrawals. The account limit is $25,000

Chase Liquid Card

- Important Features: Monthly fee waived if got Chase Premier Checking

- Credit Check: Yes

- Activation Fee: No

- Monthly Fee: $4.95

- ATM Network: Over 16,000 ATMs (Free at Chase ATMs, $2.50 others)

- Purchasing: No fees

- Ways to Reload: Cash at Chase ATMs branches, Direct Deposit, Bank Transfer, Checks, Chase Mobile Check

This is a good card if you have a Chase premium account or want to do reloads online as a method. It also offers free online pay and free transfers through Zelle (money arrives right away). There are no activation fees, but a credit check might be done. Monthly Deposit Limit of $4,000

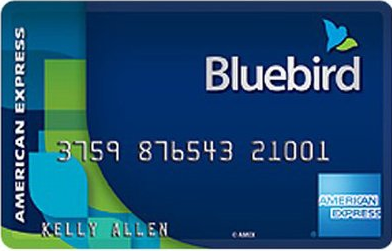

Bluebird by American Express

- Important Features: Card issued Partnership with Walmart – get benefit there

- Credit Check: No

- Activation Fee: No

- Monthly Fee: None

- ATM Network: Free at MoneyPass Network ATMs (25,000), $2.50 others

- Purchasing: No fees

- Ways to Reload: Debit Card transfer, Direct Deposit, card-to-card transfer, mobile check, Cash load at Walmart

This is an excellent card. There are no credit checks, activation or monthly fees. In addition you can load and money without any fees. American Express have partnered with Walmart with this card which gives an extra kicker. Furthermore, you can set-up 4 sub-accounts for family members and savings accounts. Monthly Deposit Limit of $5,000

Movo Virtual Prepaid Visa Card

- Important Features: Offers Cash Bank at retailers

- Credit Check: No

- Activation Fee: No

- Monthly Fee: None

- ATM Network: 6,000 ATMs in Visa Plus Alliance (Free at Alliance, $2.00 at others)

- Purchasing: No fees

- Ways to Reload: Direct Deposit, Withdrawal from Paypal or Venmo, Cash at retailers with MonayPak, and Visa Readylink

Movo’s virtual card works perfectly if you purchase a lot of things online and if you use Paypal and Venmo actively. There are no credit checks, activation or monthly fees. In addition you can load and money without any fees. The account limit is $4,000 (could change)

Akimbo Prepaid Mastercard Card

- Important Features: Offers up to 5 secondary cards

- Credit Check: No

- Activation Fee: No

- Monthly Fee: None

- ATM Network: $1.98 per withdrawal + ATM operator fee

- Purchasing: $0.99/each for first 5 purchases using fee

- Ways to Reload: Direct Deposit, card-to-card transfer, mobile check deposits, bank transfers. Cash through retailers in Mastercard rePower or Green Dot Reload

Akimbo’s card is very good for budgeting purposes.

FamZoo Prepaid Card

- Important Features: Offers up to 4 secondary, Free card-to-card transfer

- Credit Check: No

- Activation Fee: No

- Monthly Fee: $2.50-$5.99

- ATM Network: Free at MoneyPass Network ATMs (25,000), fees can apply outside

- Purchasing: $0.99/each for first 5 purchases using fee

- Ways to Reload: Direct Deposit, card-to-card transfer, bank transfers. Paypal transfer, PopMoney, Cash at retailers such as 7/11 and Walgreens

This card is a very good prepaid card for parents that want to be able to monitor and give access to their kids. There are in total 4 cards can be part of the monthly plan. Optionality for reloads through Paypal and PopMoney account. One major downside is that there is a monthly fee and potential retail fees when reloading.

Additional Reading

These Are the Best Cash Back Credit Cards

Want to Get a Good Credit Card When Having a Low Credit Score? These are The Best Cards

Note: buckgenius does not guarantee the correctness of the various offerings in this article. This information have been gathered from providers and various information sites such as J. D Power. They might change at any given moment. The reader is suggested to check with the providers about the most up to date offerings.