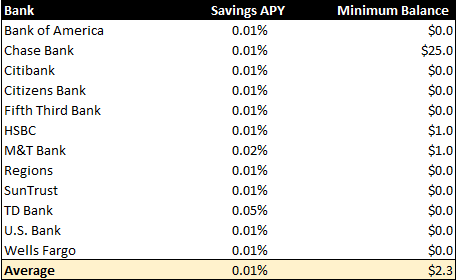

The interest rates most banks pay on savings accounts are close to zero. When reporting savings interest, banks show what is called Annualized Percentage Yield (APY). You get only 0.01% in savings interest rates on average on accounts which you don’t need to have at least several thousand dollars in.

There are though savings accounts which banks don’t talk about which you can with a simple couple of clicks get over 200x more in savings interest rate than what one gets at the big banks without needing to have hundred thousand of savings. Below is an outline of 5 accounts that gives you over 2.00% in yearly savings rate (APY). This is 200x more than your normal savings account. All these accounts are easy to open and have no complicated forms or fees.

Marcus – By Goldman Sachs

- Savings Interest Rate: 2.25%

- Minimum: $1

- Monthly Fee: None

The Wall Street bank offers an excellent savings account option. You open the account online in a couple of clicks. There are no transaction fees either. You have access customer support via online or phone numbers.

American Express – Personal Savings

- Savings Interest Rate: : 2.10%

- Minimum: $1

- Monthly Fee: None

In addition offering credit cards, American Express also offers an amazing savings account option. There are no monthly fees or minimum balances. You have 24/7 access to customer support. Furthermore you can connect to three other accounts you have at other banks to make online transfers.

Barclays – Online Savings Account

- Savings Interest Rate: : 2.20%

- Minimum: $1

- Monthly Fee: None

Barclays Online Savings Account is one of the best available. There are no minimums, nor any other type of fees. As a saver you transfer money to and from the account via their website and mobile app. You have also access to phone services between 8am-8pm during weekdays.

Synchrony – High Yield Savings Account

- Savings Interest Rate: : 2.25%

- Minimum: $1

- Monthly Fee: None

Synchrony Online Savings Offering is amazing. When one opens an account one also receives a card for free ATM withdrawals across the country. There are no minimum balances, no monthly fees and no other fees for withdrawals for less than 6 times a month.

Ally – Online Savings Account

- Savings Interest Rate: : 2.20%

- Minimum: $1

- Monthly Fee: None

Ally the Online Bank that has one of the best user and customer experience. One can deposit checks through a mobile app. You can also easily transfer money to the account online for free. There are no minimums or any type of fees. Customer support is available through phone, chat, email and twitter. This is an excellent account for those that do most of their business through their mobile phone.

As can be seen above, you don’t have to be a millionaire to get excellent savings interest rates easily and fast without any type of fees.